eBooks

Filter by type

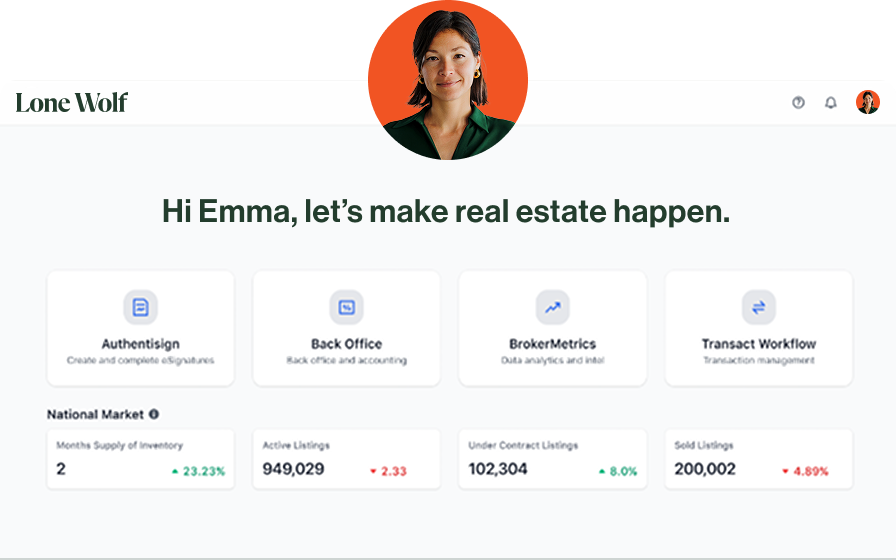

Accounting & Operations

Streamline your back office, accounting, and other financial workflows.

Analytics & Insights

Make the most out of your market data and other insights to recruit & grow your business.

Marketing & Leads

Explore ways to fill your pipeline, generate leads, and stand out in today's market.

Tips & Tricks

Unlock expert insights to elevate your skills and achieve more.

Transaction Management

Explore best practices to your optimize workflows & close your next deal with confidence.