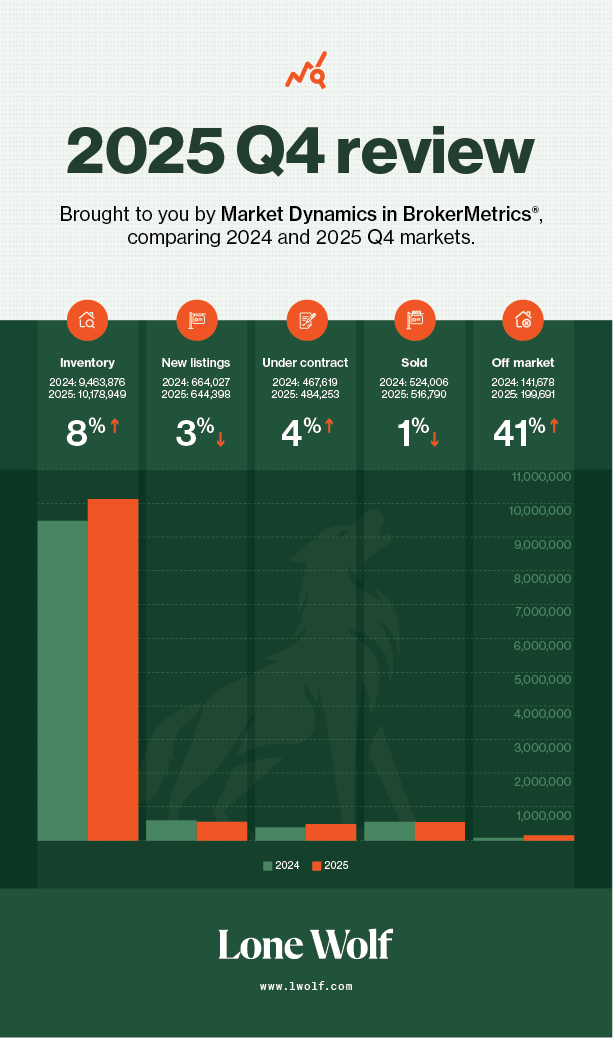

A review of Q4 2025 real estate trends with BrokerMetrics market analysis

View the report

Q4 2025 real estate market analysis snapshot

- Inventory up 7.5% in Q4 2025, while new listings declined → homes staying on the market longer.

- Buyer demand remains strong, but closed sales dipped slightly → friction between contracts and closings.

- Off-market activity surged 41% → indicates seller uncertainty.

- Lone Wolf BrokerMetrics turns these trends into clear, data-backed insights for smarter decisions in 2026.

A deeper dive into Q4 2025 real estate trends with BrokerMetrics

The real estate market is never static. The transition from 2024 to 2025 has proven this rule once again. As we look at the Q4 2025 data, a clear picture emerges of a market in flux. For agents and brokers, understanding these shifts is essential to guiding teams and advising clients effectively.

The real estate market analysis reveals a landscape where inventory is growing, but sales are tightening. Perhaps most notably, off-market activity has surged, suggesting a shift in strategy for many sellers. Here’s a look at the latest data from BrokerMetrics, the real estate data and market analysis tool that turns market shifts into clear, actionable insights for today’s real estate pros.

Inventory rises as market shifts

- Inventory is rising: Active listings increased from 9,463,876 in 2024 to 10,178,949 in 2025, a 7.5% year-over-year jump.

- Buyer choice is expanding: More inventory gives buyers greater options, increasing the risk of longer days on market without competitive pricing.

- Seller expectations need recalibration: Agents have a clear opportunity to coach sellers on realistic pricing and timelines.

- Standing out matters more than ever: With over 10 million active listings, success depends on sharp marketing and precise pricing.

New listings see a slight decline

- New listing activity is slowing: New listings declined nearly 3% year over year from 2024 to 2025.

- Inventory is accumulating: Fewer new sellers are entering the market, causing existing inventory to build.

- Seller hesitation is a factor: Interest rate uncertainty and a wait-and-see mindset are likely holding potential sellers back.

- Opportunity for proactive outreach: Agents who actively engage their sphere can uncover motivated sellers who may just need guidance or reassurance.

Contract activity shows resilience

- Buyer demand remains resilient: Properties under contract increased 3.56% year over year, rising from 467,619 in 2024 to 484,253 in 2025.

- Intent is still strong: The growth in contracts signals that serious buyers are continuing to move forward, despite market uncertainty.

- Inventory hasn’t stalled demand: More listings and market noise haven’t stopped qualified buyers from acting.

- Agent engagement matters: Agents who stay closely connected to active buyer leads are best positioned to turn demand into closings.

Closed sales face a minor setback

- Closings have dipped slightly: Sold properties declined 1.38% from 2024 to 2025, even as contracts rise.

- Gap indicates transaction friction: Delays may stem from financing issues, inspections, or buyer hesitation.

- Critical focus for brokers: Closing the gap between contracts and completed sales requires strong oversight and contract-to-close execution.

- Technology can help: Tools like Lone Wolf Transact can streamline processes and convert more pending deals into revenue.

Off-market activity spikes

- Off-market activity surged: Properties going off market jumped nearly 41%, from 141,678 in 2024 to 199,691 in 2025.

- Sellers are testing the market: Many listings are being withdrawn or moved to private sales, signaling uncertainty or dissatisfaction with results.

- Opportunity for brokers: Understanding why listings aren’t converting is key.

- Focus areas to unlock value: Pricing, property condition, and marketing reach are critical levers that can improve listing performance and drive business growth.

Navigating the year ahead

The real estate market data from the fourth quarter paints a complex picture: rising inventory and resilient buyer interest mixed with fewer closings and a spike in withdrawn listings.

For brokerage leaders, the path forward involves focusing on fundamentals. Equip your team with the data they need to have honest conversations with clients. Double down on transaction management to ensure contracts turn into closings. And keep a close eye on that off-market trend—re-engaging those discouraged sellers could be a major source of business in the coming year.

By staying ahead of these trends, you position your brokerage not just to survive the shifts, but to grow through them.

The market is ever changing, but you can stay one step ahead with BrokerMetrics.

Get started with BrokerMetricsOther resources

See more eBooks, webinars, and blog articles to help you stay ahead with strategies designed for your success.